I’ve seen a lot of construction over the years.

As a kid from Wichita, Kansas, I watched the city expand as the global capital of air travel. Companies like Boeing and its competitors set up shop, and the entire area boomed.

In South Carolina, as the editor of a business publication, I witnessed the Upstate of South Carolina expand as businesses like BMW Manufacturing and Michelin North America built massive plants.

Even here in South Florida, I see new construction sites pop up all the time.

People follow businesses. When there are new commercial construction projects, residential construction is not far behind.

And construction spending has already hit new highs.

Total construction spending in the U.S. topped more than $1.5 billion in January, continuing an upward trend of the past 12 months.

And that got me thinking about ways to invest in this trend.

All About Electricity

Encore Wire Corp. (Nasdaq: WIRE) supplies wiring and cables used in the interior of new commercial and residential buildings.

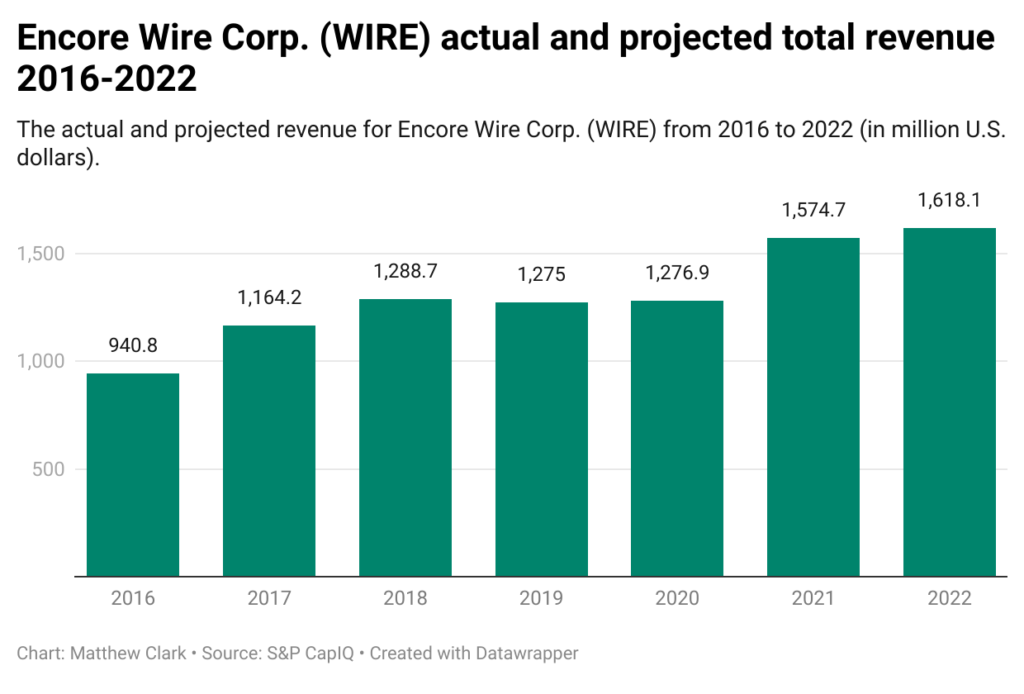

Since 2016, the company revenue has grown every year.

Looking ahead two years, Encore is expected to raise its revenue from $1.27 billion in 2020 to $1.62 billion by 2022 — a 27.5% increase.

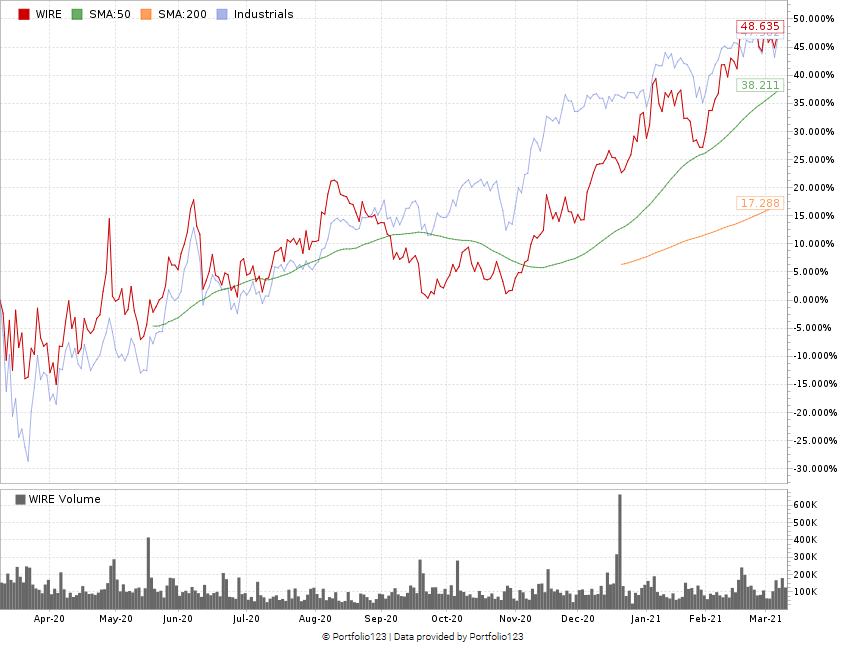

Encore’s stock price also took off.

WIRE (Red) Grows 83% in 12 Months

WIRE rose to around $55 per share in August 2020.

This month, it reached a 52-week high of $69.41 — an 83% jump off its March 2020 lows.

Since this jump, Wall Street analysts have boosted their projections for the company’s earnings and revenue in 2021 and beyond.

On average, analysts project earnings of around $4 per share on revenue of $1.6 billion.

WIRE’s Green Zone Rating

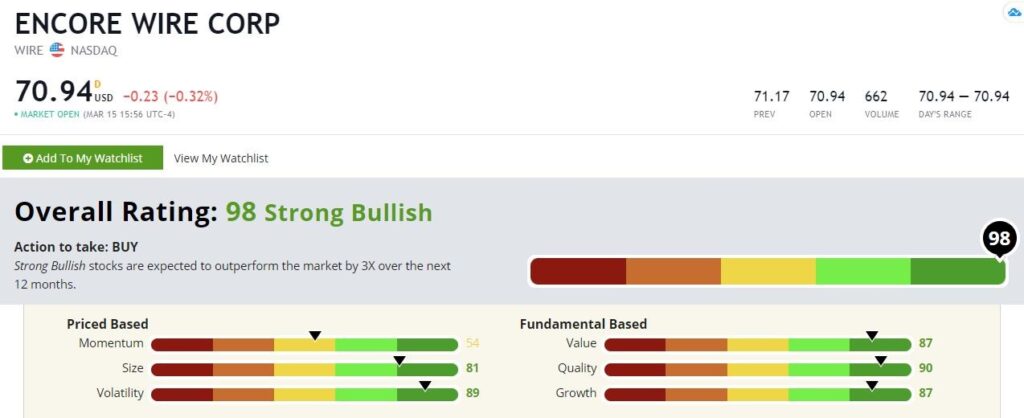

Encore Wire stock rates a 98 overall on Adam O’Dell’s six-factor Green Zone Ratings system, which means we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times over the next 12 months.

WIRE rates in the green on five of the six metrics we account for. Here’s a breakdown of the stock’s top scores:

Quality — WIRE rates a 90 on quality, which means this stock is one of the best on the market right now. The company’s stock has price-to ratios that are all much lower than the electrical equipment industry. Its returns on assets, equity and investment are all in the green — and better than the rest of the industry.

Growth — At a growth score of 87, WIRE is primed for a strong future. Encore has a five-year annual sales growth rate of 4.6% and a one-year EPS (earnings per share) growth rate of 33%. The net debt of the company was down to $183 million but if you add back in total cash and short-term investments, the total debt is $0. It also grew its net profit to $194 million in 2020 — a year when construction faced some headwinds due to the COVID-19 pandemic.

Value — WIRE is a high-value stock with a rating of 87. As an added bonus, the company does pay a modest dividend. Its forward dividend yield is 0.12%, which equals out to about $0.08 per share — not great, but better than nothing.

Bottom line: With construction booming and more on the way, Encore Wire Corp. is a construction play worth looking at for your portfolio.

Safe trading,

Matt Clark

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.

P.S. Check out The Bull & The Bear podcast every week for more picks from Adam, Charles and me. You can listen on Apple Podcasts, Spotify, Amazon and Google Podcasts. You can also catch episodes on our YouTube channel here.

"wire" - Google News

March 17, 2021 at 06:07PM

https://ift.tt/38RcpR7

Buy Encore Wire Stock as America Spends Billions to Build - Money and Markets

"wire" - Google News

https://ift.tt/2YtvSDd

https://ift.tt/2VUOqKG

Bagikan Berita Ini

0 Response to "Buy Encore Wire Stock as America Spends Billions to Build - Money and Markets"

Post a Comment