Everyone likes payday, right? Getting paid is great, but it can be annoying and inconvenient to have to bring your paycheck to a bank to deposit what you’ve earned. Even if you use a mobile banking app or ATM to deposit your check without going to a branch, it can still take a few days for the check to clear.

Enter: direct deposit, a simple way to get your hard-earned money faster.

What is direct deposit?

Direct deposit definition

Direct deposit works by letting your employer make deposits directly into your bank account instead of giving you a check to deposit yourself. This allows you to access your money quickly and easily.

How direct deposit works

When you deposit a check at a bank, your financial institution has to take the check, then reach out to the bank that issued the check. The two banks confirm all of the details of the transaction, including how much money needs to move and whether the payer has enough funds in his account. This takes time, and during that time, you might not be able to access the money you deposited.

With direct deposit, you give your employer your bank information. Ahead of payday, your employer transfers your pay to your bank, and your bank releases the funds to your account on the specific payday. As soon as payday arrives, your paycheck shows up in your account and you can spend it immediately.

Many employers let you split your direct deposits between multiple accounts, which allows you to set up automatic savings plans. For example, you could tell your employer to direct deposit $50 per paycheck to your savings account and the rest to your checking account. You’ll get to build the balance of your savings account without having to think about transferring cash manually.

How to set up direct deposit

The process for setting up direct deposit varies slightly from employer to employer, but your HR or payroll department should be able to help you get things started.

To set up direct deposit, you’ll need to know:

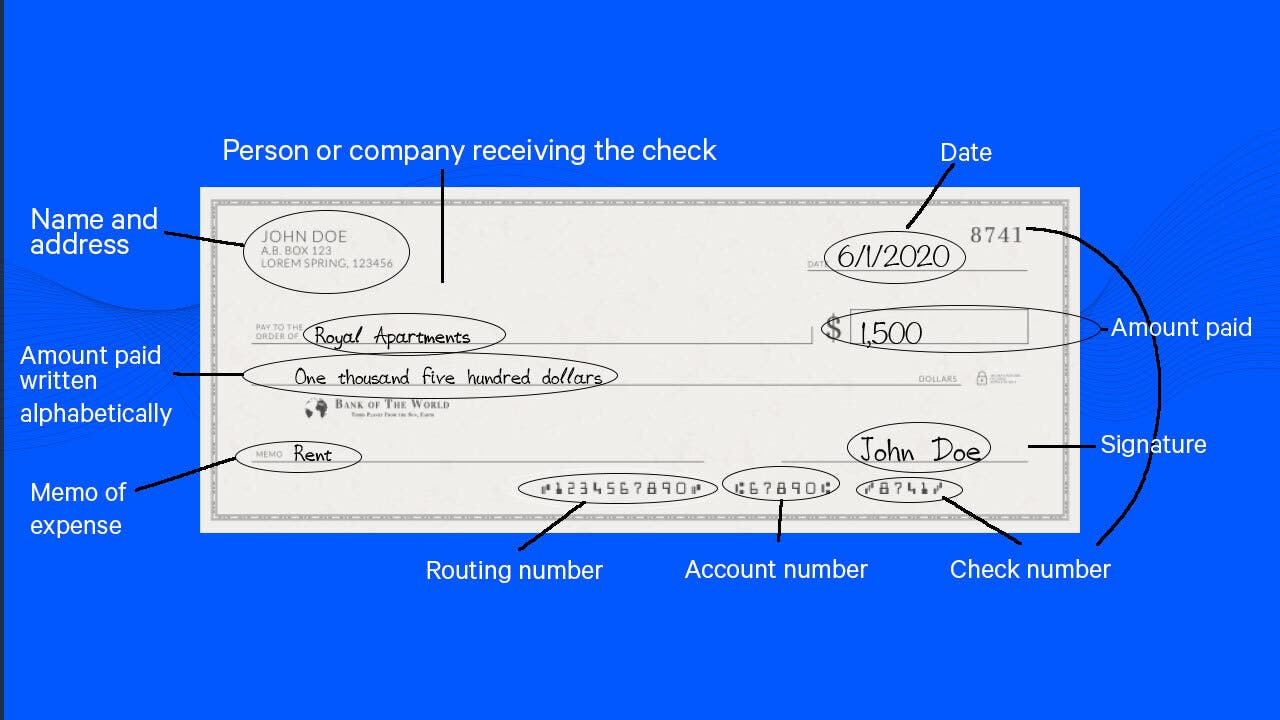

- Your bank account number and your bank routing number. The routing number tells your employer which bank to send your money to while the account number helps them make sure the money goes into the correct account at the bank.

Most banks list your account and routing numbers in their online banking portals. You can also view these numbers on the checks that came with your checking account.

The routing number is typically the first number on the bottom left of your check. It should include nine digits. The next number is your account number. After that comes the check number, which indicates how many checks you’ve written from that checkbook.

Some employers will want a voided check when you set up direct deposit to confirm your account information. That means bringing your checkbook with you when setting up direct deposit is a good idea. To void a check, simply write VOID on it in large letters, or in smaller letters multiple times in the important fields, like the payment amount. You can also write VOID on the back if you’d like.

What perks you will get from your bank account

Banks offer many perks to customers that set up direct deposit to their checking accounts.

One of the most common perks is a maintenance fee waiver. Some banks charge monthly fees on checking accounts, but commonly waive the fee if you maintain a sufficient balance or receive a direct deposit each month.

Other banks offer higher interest rates on checking or linked savings accounts if you meet certain requirements. Making a minimum number of debit card transactions and receiving direct deposits are common requirements.

Some banks and challenger banks like Chime even give you early access to your paycheck. Your employer will usually send your paycheck to the bank a few days ahead of payday to give the transfer time to process. These banks release the money as soon as the transaction clears rather than making you wait until payday.

Given that direct deposit is convenient and saves you the effort of depositing your paycheck on your own, these perks just provide more reasons to set up direct deposit.

Bottom line

Setting up direct deposit is typically easy and can save you a lot of time. You won’t have to worry about collecting a paycheck every week and visiting the bank to deposit it; the money will simply arrive in your account. Splitting your direct deposit between your checking and savings accounts is also a great way to automate your savings, adding even more benefits to setting up direct deposit.

Learn more:

"direct" - Google News

August 19, 2020 at 07:00PM

https://ift.tt/2Ybi8vK

What is direct deposit? Here’s how it works - Bankrate.com

"direct" - Google News

https://ift.tt/2zVRL3T

https://ift.tt/2VUOqKG

Direct

Bagikan Berita Ini

0 Response to "What is direct deposit? Here’s how it works - Bankrate.com"

Post a Comment