WASHINGTON — Several small business owners were mistakenly funded twice through the Small Business Administration’s rescue loan program after they submitted multiple applications to different financial institutions.

What You Need To Know

- Several small business owners didn't get money from 1st round of PPP

- They were encouraged to reapply with different bank in 2nd round

- Some banks required direct deposit; multiple banks sent money, owners say

- Business owners waiting on guidance on what to do with extra money

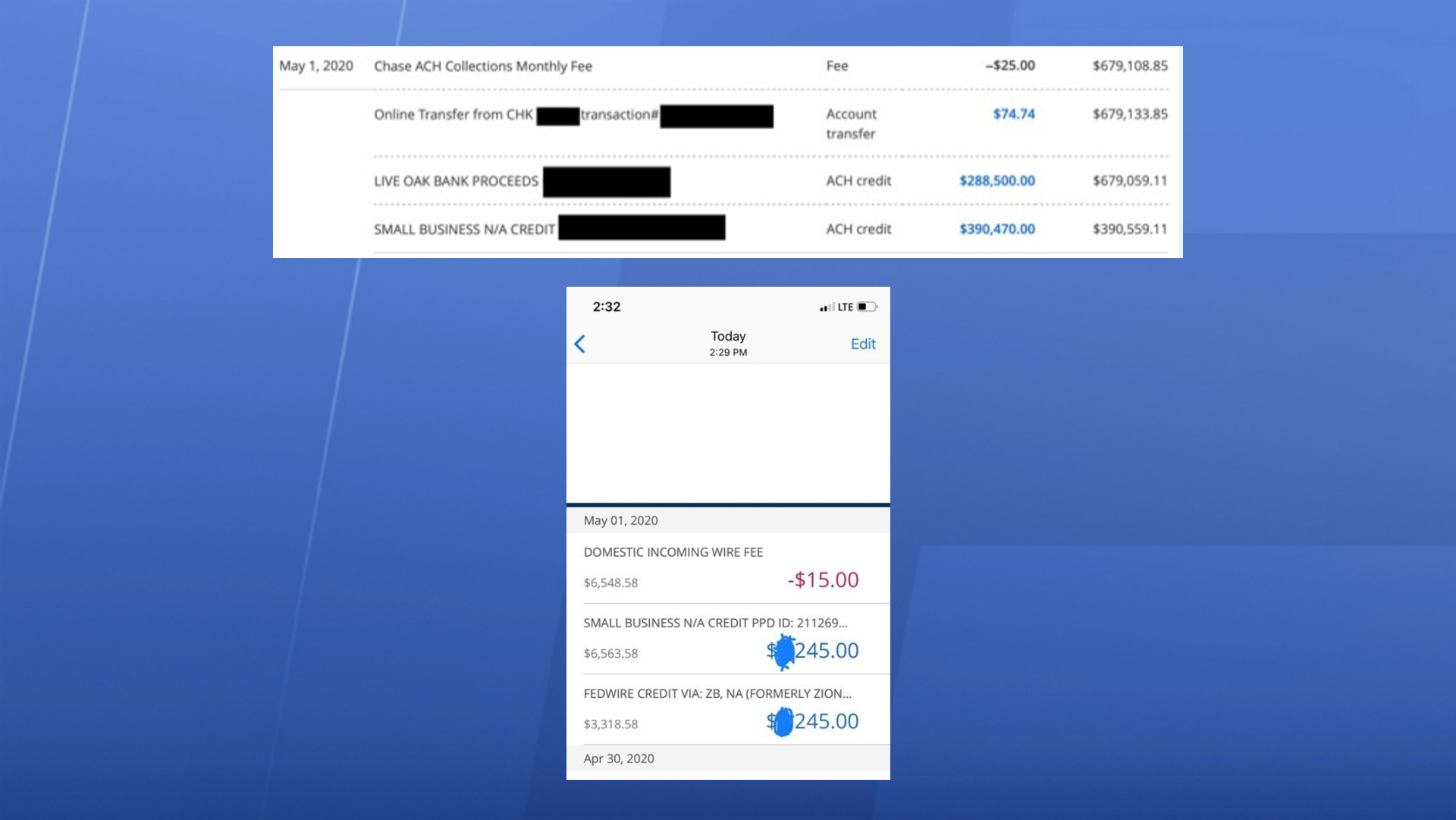

Spectrum News has independently verified at least five cases in which borrowers discovered that duplicate loans were direct-deposited into their bank accounts last Friday after they applied for the Paycheck Protection Program through Chase or PayPal.

Rita Zapko, an enrolled agent with Devlin Financial who works as a small business and tax consultant, discovered the funding issue with several of her small business clients.

"We saw the wires pending, and we were thinking it was going to get halted at some point, and then the wires settled," she told Spectrum News. "We thought we would get guidance on this in the next 48 hours and figure out how to click a button and say, 'Duplicate funds received in error, return please.' But that hasn’t happened."

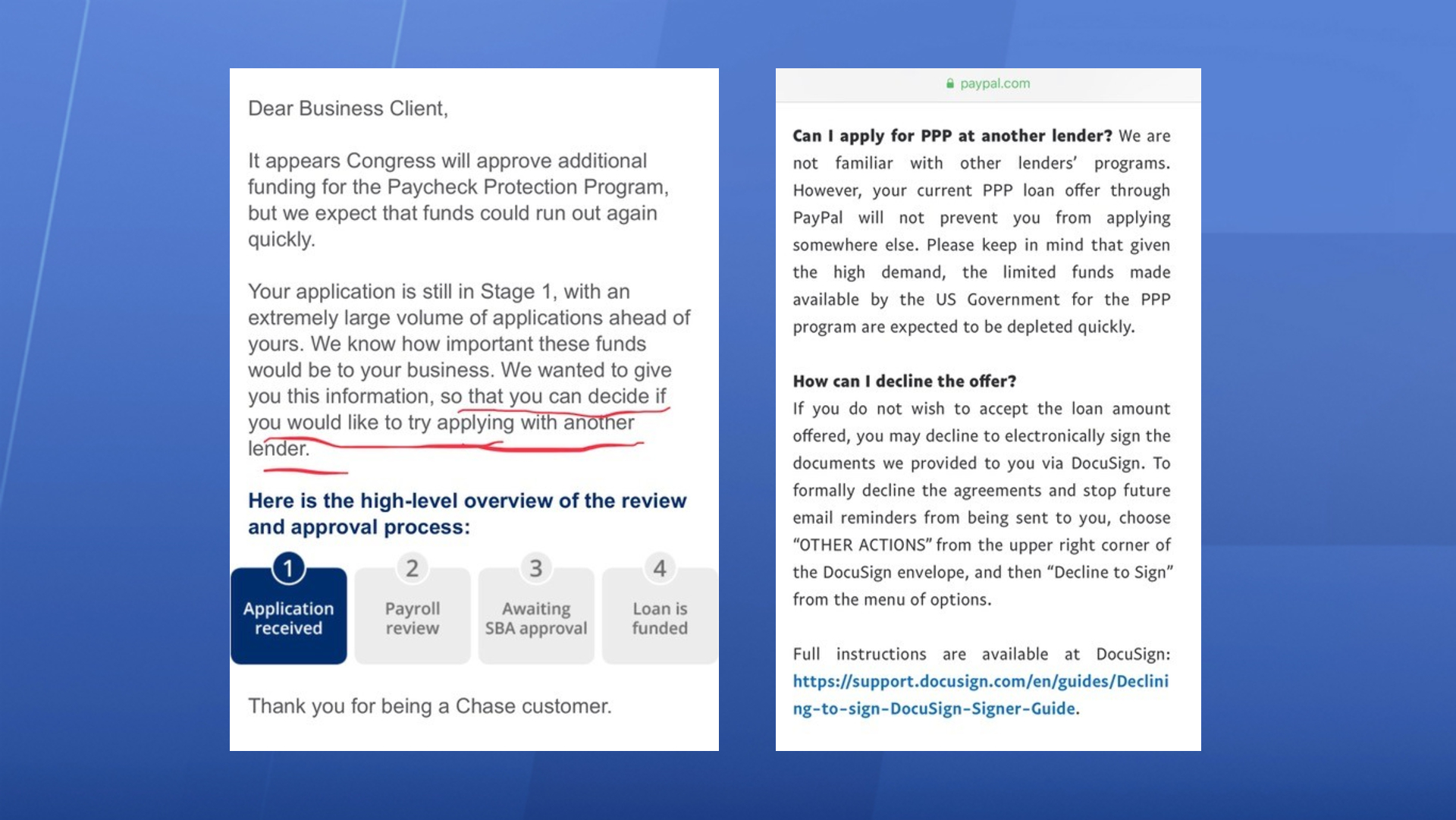

PPP policies from Chase Bank and PayPal to loan applicants suggest applying with another lender. (Screen captures)

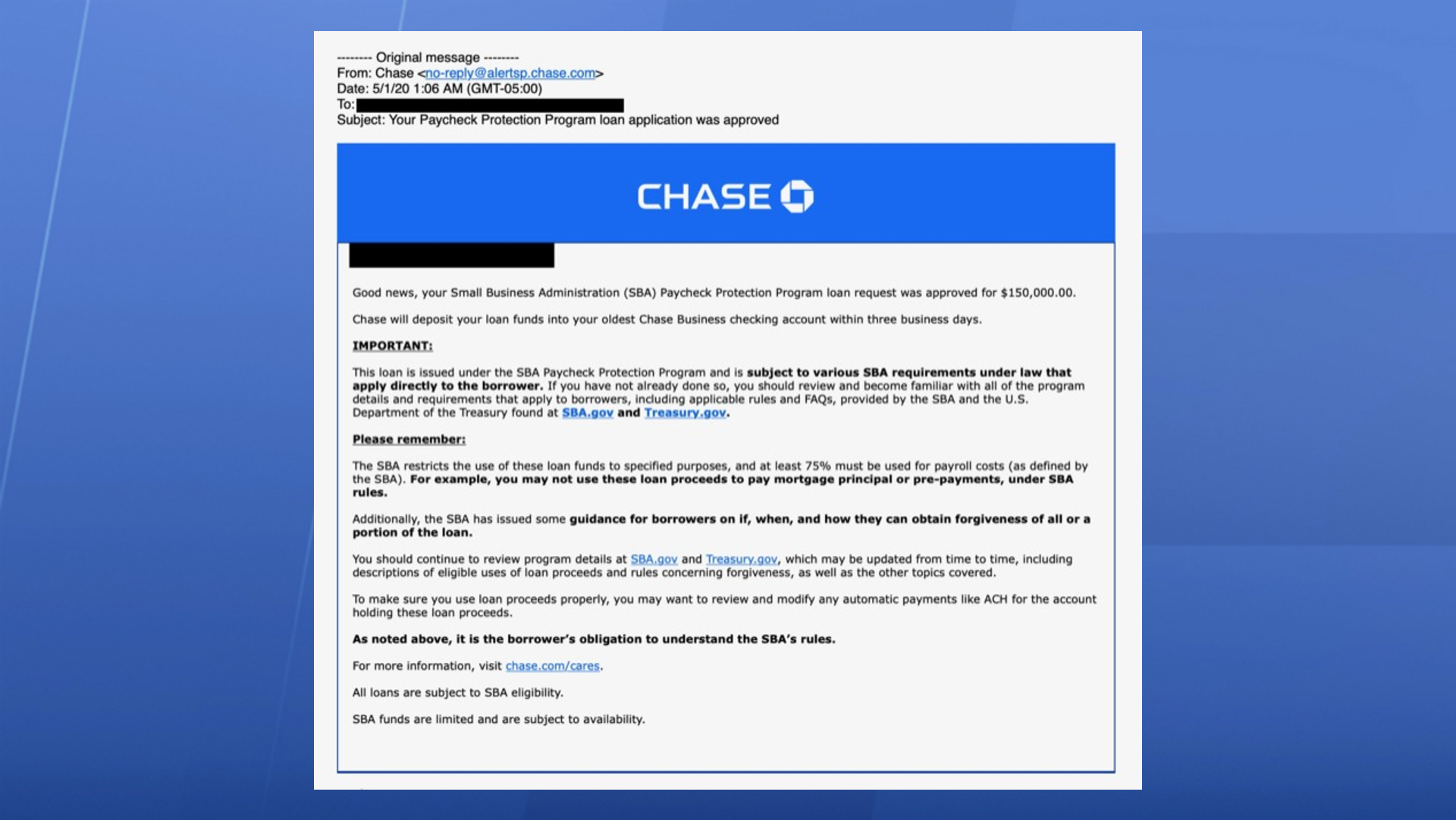

The same situation has played out with other applicants, who were notified that their loans had been approved and deposited by different lenders almost simultaneously. In both Chase and PayPal applications for the program, small business owners were required to sign a promissory or direct-debit note before the loan was approved and disbursed. This step in the process was designed to get the money out quickly. However, it prevented small business owners from being able to accept or reject the funding before it hit their accounts.

"All the lenders had different processes and had different forms. They are following the same law, but if you and I read the same paragraph, we are going to come to a different interpretation," Zapko said.

"Some of the banks, like Bank of America, they sent the promissory note afterwards, so if you’ve been funded already, you have a chance to tell them and reject the funding. With the way Chase, PayPal, and I think Loan Source did it, you did not have a chance to stop it.”

An email from Chase Bank notifying a business loan applicant that their loan request was approved by the SBA. (Screen capture)

After the first round of the government’s nearly $350 billion loan program was depleted in just a matter of days, many small business owners say they were encouraged to apply with multiple lenders to increase their chances of receiving money in the second round.

Chase Bank sent out an email to borrowers after the program ran out of funding, suggesting that they may want to apply for the program elsewhere. PayPal also clearly stated in guidance on its website that any current applications do not prevent borrowers from applying somewhere else. Several small business owners reached out to members of Congress after they did not receive funding in the first round and were directed to apply again through a smaller community bank.

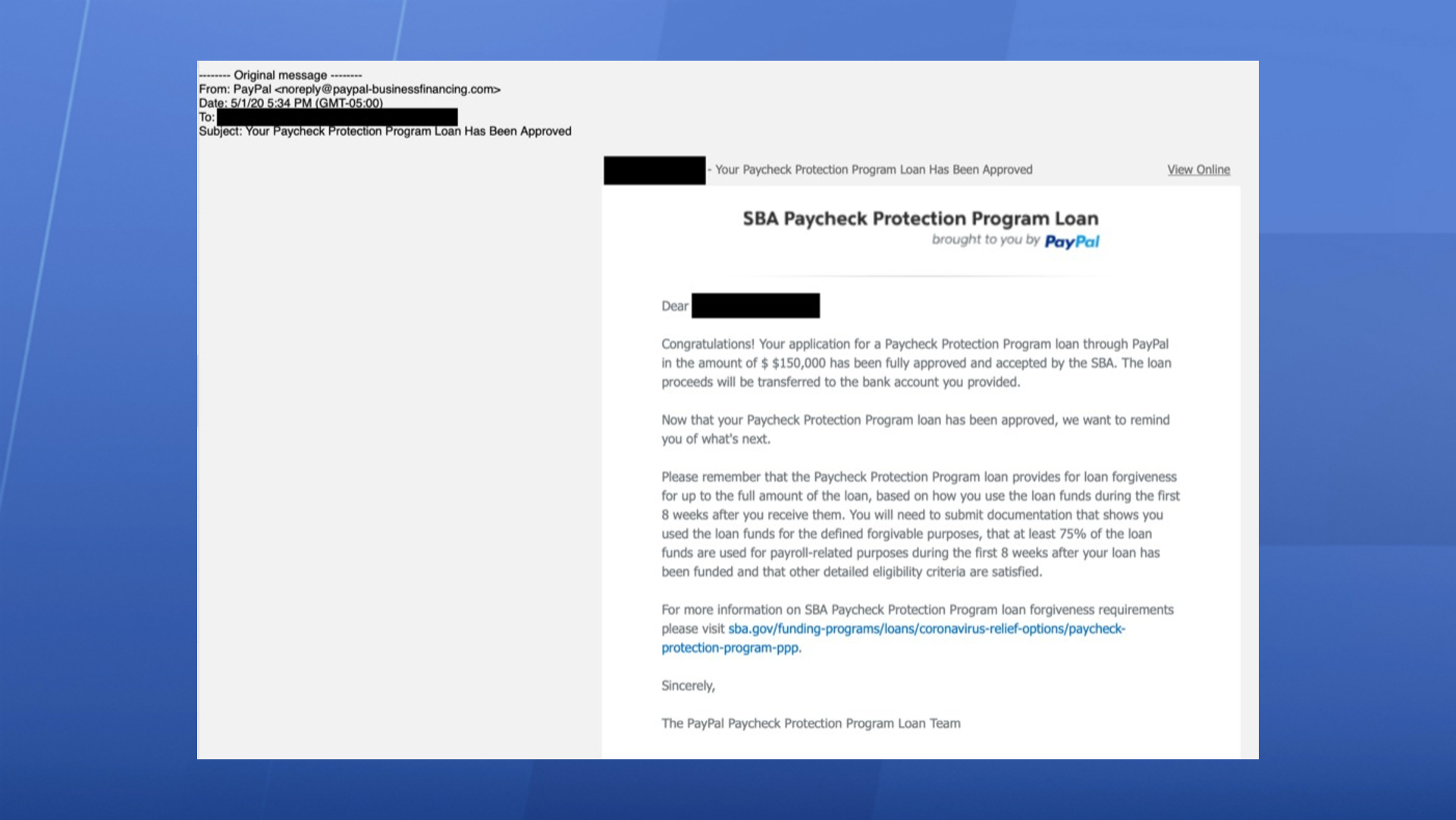

"I lost all faith in Chase being able to come through. I didn’t know where I was in the pecking order in terms of getting funded, so I decided to go through somebody else as a backup," said a business owner in Indiana who wished to remain anonymous but ultimately got duplicate loans of $150,000 from both Chase and PayPal.

The SBA has approved more than 2.2 million loans worth more than $175 billion of the total $310 billion that Congress approved in the latest coronavirus relief package. There were more than 1.6 million loans approved in the first round of funding.

Chase Bank acknowledged it was aware of the duplicate funding issue.

"We have funded more than 239,000 PPP loans. A handful of customers have reported they were also funded by another institution as well. The SBA will respond to each customer directly to determine next steps," said Anne Pace, a spokeswoman with Chase Bank.

An email from PayPal notifying a business loan applicant that their loan request was approved by the SBA. (Screen capture)

Spokespeople for SBA, the Treasury, and PayPal did not respond to requests for comment but said they were looking into the issue.

"We didn’t tell people to apply with multiple lenders at first. We thought that would clog up the system. After the first round was a disaster, then all the other lenders opened up, and we figured there would be a shorter queue, so it made sense to go with them,” Zapko said.

"Nothing said you couldn’t apply for two; it just said you couldn’t accept two," she said.

It's unclear whether the duplicate funding error was made by the banks or the Small Business Administration. Those who were funded twice say they submitted multiple applications with the same Employer Identification Number, which should have been flagged by the SBA before it entered the agency’s loan servicing portal. Each loan should have been given an SBA loan number before it was submitted.

"It’s absolutely possible that this happened. With something like this that is only a month old, that started out very quickly, that has a bunch of other glitches," said U.S. Sen. Marco Rubio of Florida, chairman of the Small Business Committee and an architect of the program.

"They should notify their lender in writing, notify the SBA in writing, plus call the lender that made the loan, and tell them what happened and try to get them the money back as quickly as possible, to avoid any future problems," Rubio added.

Rubio said those who received duplicate loans will not be penalized if they are transparent about the error.

Screen captures show PPP loan money was direct-deposited into a business owner's bank account. (Screen captures)

Borrowers who received multiple loans said they have not received any direction from lenders or the SBA about how to return the excess funding from the Paycheck Protection Program. Many are concerned that they could ultimately lose funding for both loans if they don’t receive proper guidance.

Zapko said she worries the program could be susceptible to fraud as a result of the error.

"I’m not confident they have fixed it yet. I think most people are going to return the money very quickly because they're concerned that they just accidentally committed a crime. But, you’re going to have a percentage of people who aren’t going to give the money back," she said.

"direct" - Google News

May 06, 2020 at 11:37PM

https://ift.tt/2SKFV33

Confused Small Business Owners Get Duplicate Direct Deposits From PPP - News 13 Orlando

"direct" - Google News

https://ift.tt/2zVRL3T

https://ift.tt/2VUOqKG

Direct

Bagikan Berita Ini

0 Response to "Confused Small Business Owners Get Duplicate Direct Deposits From PPP - News 13 Orlando"

Post a Comment